Friday the 12th of June 2020 the german government decided to cut the value added tax (VAT) by 3% for half a year. This rule shall be passed on 29th of June (N-TV) to take effect from first July on.

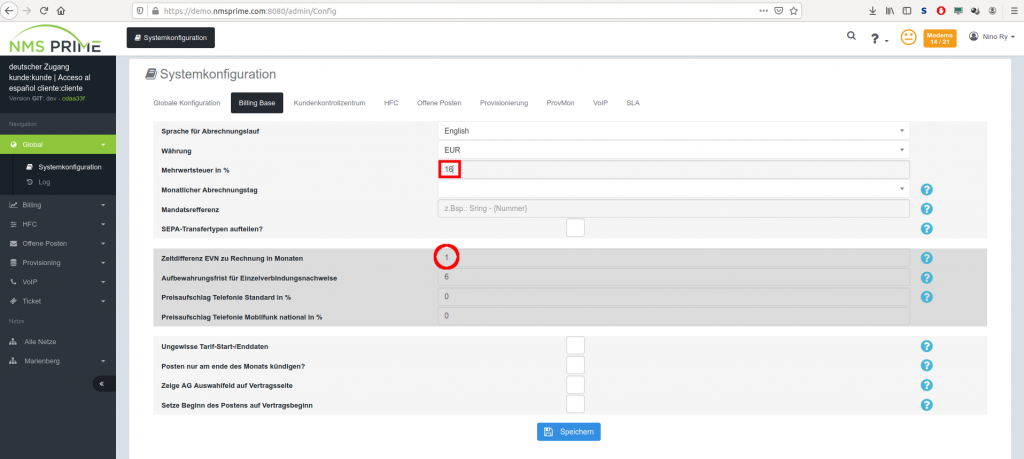

Now this has to be shown correctly on the invoices of your customers. There’s not much to do for that. To adapt the percentage rate you just have to set it in the billing tab of the system configurations – see the following picture.

If you charge the telephony call data records (CDRs) delayed (red circle in picture 1), because your provider provides them very late then there’s another problem. As the VAT refers to the period of service you would have to calculate with two different percentages and show them on the invoices. Therefore we would have to do bigger adaptions to the settlement run process and the invoice templates. As this event will very likely occure very rarely we want to save valueable resources and use them for developments that help you more during the daily business.

In conversations with multiple ISPs an easier solution popped up. So we would combine the CDRs of may and june in the settlement run of july (for june). In august (for july) no CDRs would appear on the invoice then. In january (for december) and february (for january) we would handle it the same way. By that we only have service periods of the same VAT percentage on one invoice.

Because of the exceptional situation we think that the very largest part of your customers will understand this treatment. Nevertheless we recommend to inform you customers before. Also we will contact all ISPs that are supported by us before performing the necessary tasks.